Signed, Sealed, Delivered: A Rough Path to Better Volatility Models

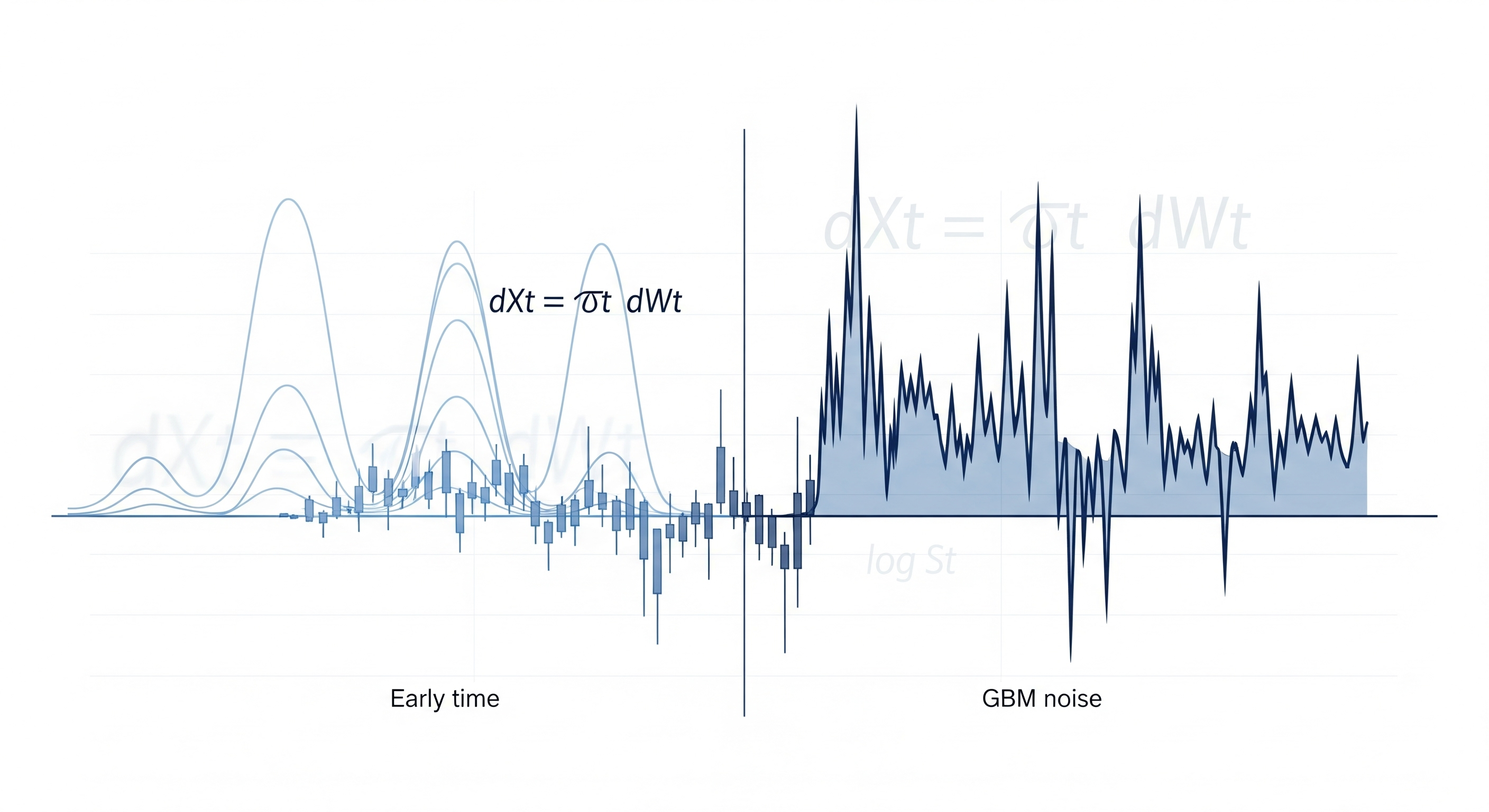

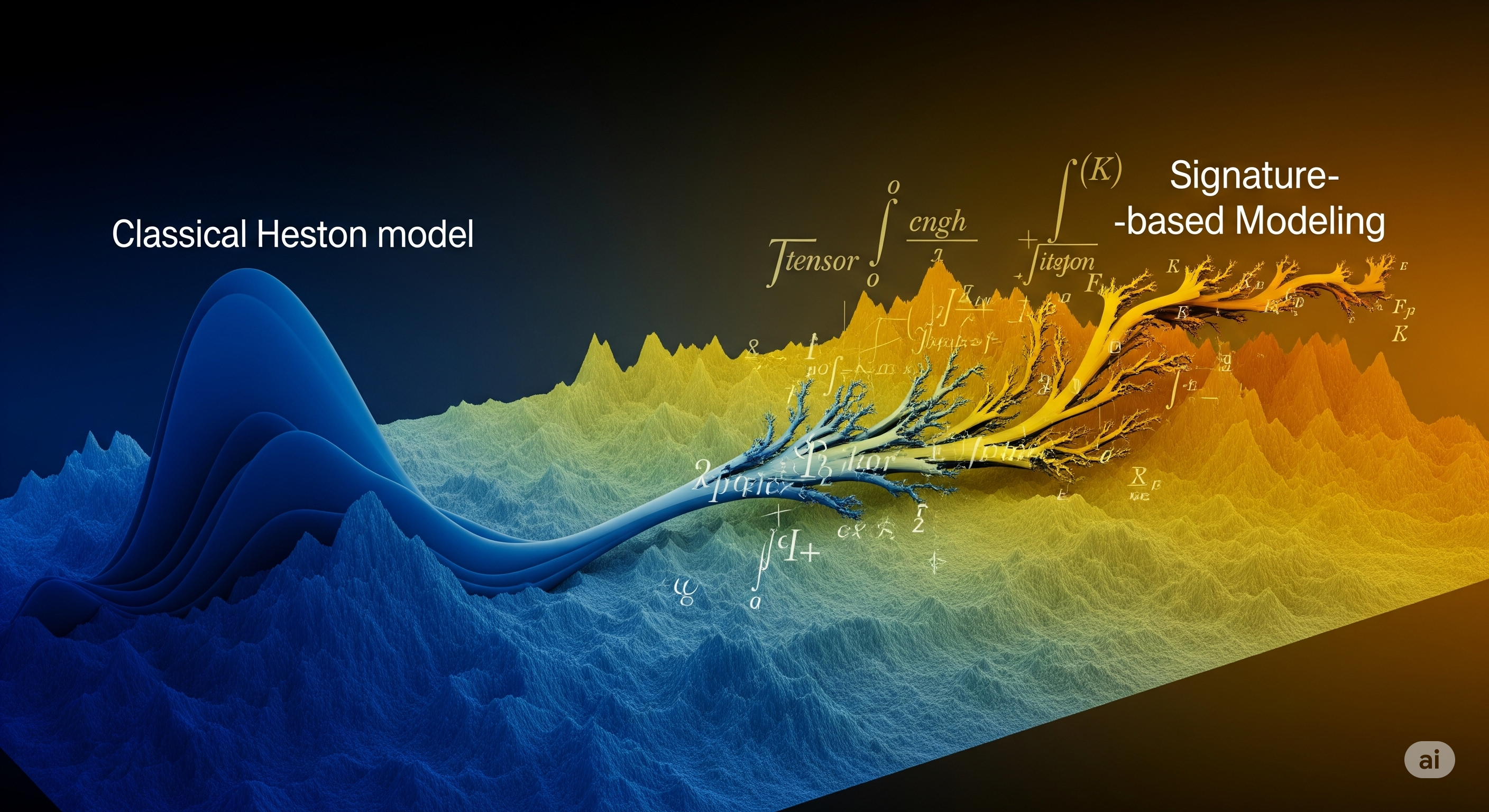

Financial engineers have long sought to tame the volatility surface. From Black-Scholes to Heston, modelers have used parametric tricks to approximate implied volatilities across strikes and maturities. But what happens when the surface refuses to play along—when volatility is rough, the market isn’t Heston, and no closed-form expansion suffices? In today’s article, we explore a signature-based approach from rough path theory that aims to solve this exact problem. The method not only matches the performance of classical asymptotic expansions in well-behaved markets, but even excels when things get bumpy. ...