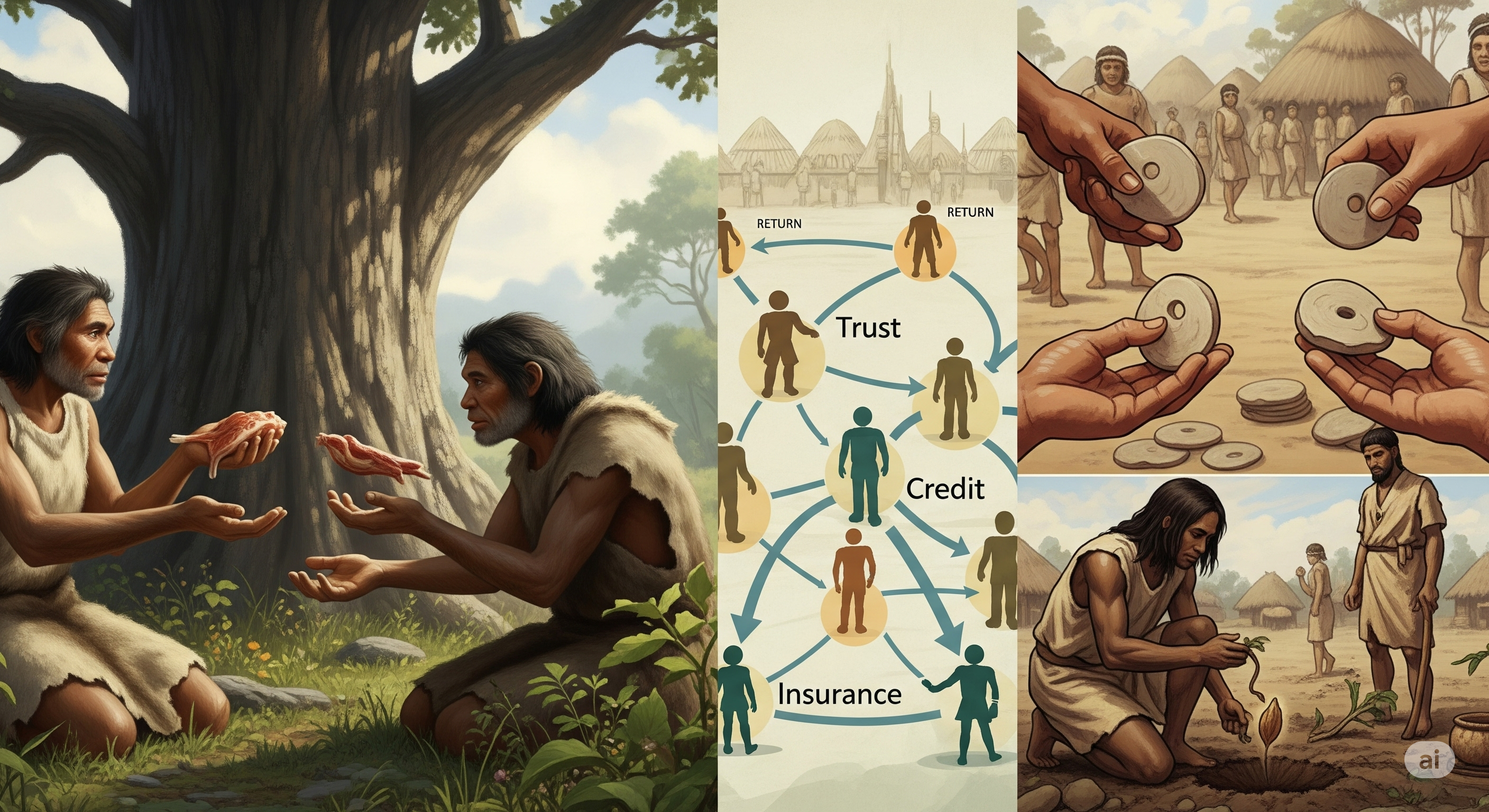

The Roots of Finance: How Reciprocity Explains Credit, Insurance, and Investment

Finance may seem like the crown jewel of modern institutions—replete with contracts, algorithms, and global markets. But what if its deepest logic predates banks, money, and even language? In a compelling new paper, Finance as Extended Biology (arXiv:2506.00099), Egil Diau argues that the cognitive substrate of finance is not institutional architecture but reciprocity—a fundamental behavioral mechanism observed in primates and ancient human societies alike. Credit, insurance, token exchange, and investment, he contends, are not designed structures but emergent transformations of this ancient cooperative logic. ...