Quantum Bulls and Tensor Tails: Modeling Financial Time Series with QGANs

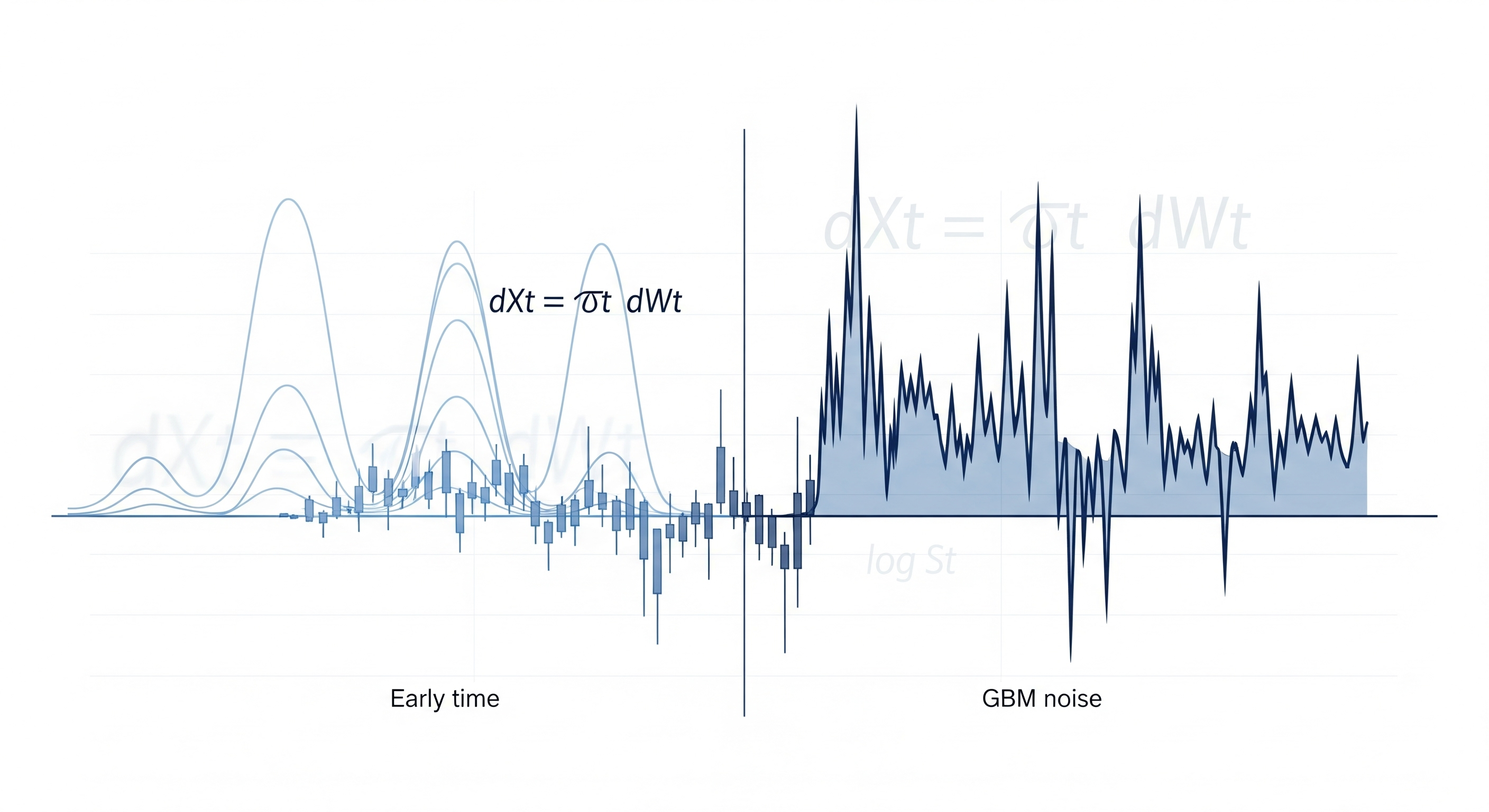

If you’re tired of classical GANs hallucinating financial time series that look right but behave wrong, you’re not alone. Markets aren’t just stochastic — they’re structured, memory-laced, and irrational in predictable ways. A recent paper, Quantum Generative Modeling for Financial Time Series with Temporal Correlations, dives into whether quantum GANs (QGANs) — once considered an esoteric fantasy — might actually be better suited for this synthetic financial choreography. ...