Speaking Fed with Confidence: How LLMs Decode Monetary Policy Without Guesswork

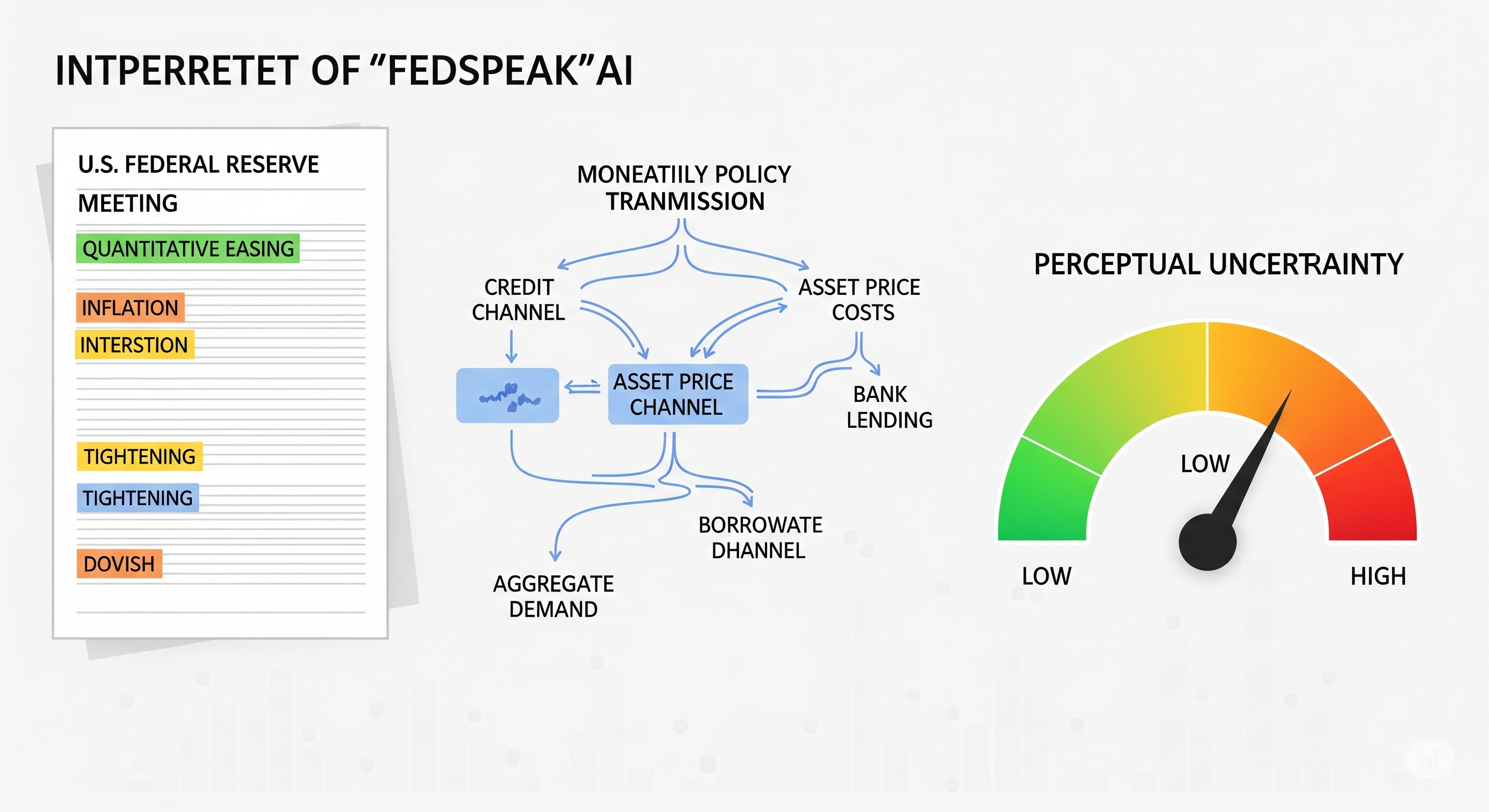

The Market-Moving Puzzle of Fedspeak When the U.S. Federal Reserve speaks, markets move. But the Fed’s public language—often called Fedspeak—is deliberately nuanced, shaping expectations without making explicit commitments. Misinterpreting it can cost billions, whether in trading desks’ misaligned bets or policymakers’ mistimed responses. Even top-performing LLMs like GPT-4 can classify central bank stances (hawkish, dovish, neutral), but without explaining their reasoning or flagging when they might be wrong. In high-stakes finance, that’s a liability. ...