Finance may seem like the crown jewel of modern institutions—replete with contracts, algorithms, and global markets. But what if its deepest logic predates banks, money, and even language? In a compelling new paper, Finance as Extended Biology (arXiv:2506.00099), Egil Diau argues that the cognitive substrate of finance is not institutional architecture but reciprocity—a fundamental behavioral mechanism observed in primates and ancient human societies alike. Credit, insurance, token exchange, and investment, he contends, are not designed structures but emergent transformations of this ancient cooperative logic.

The Biological Heart of Finance

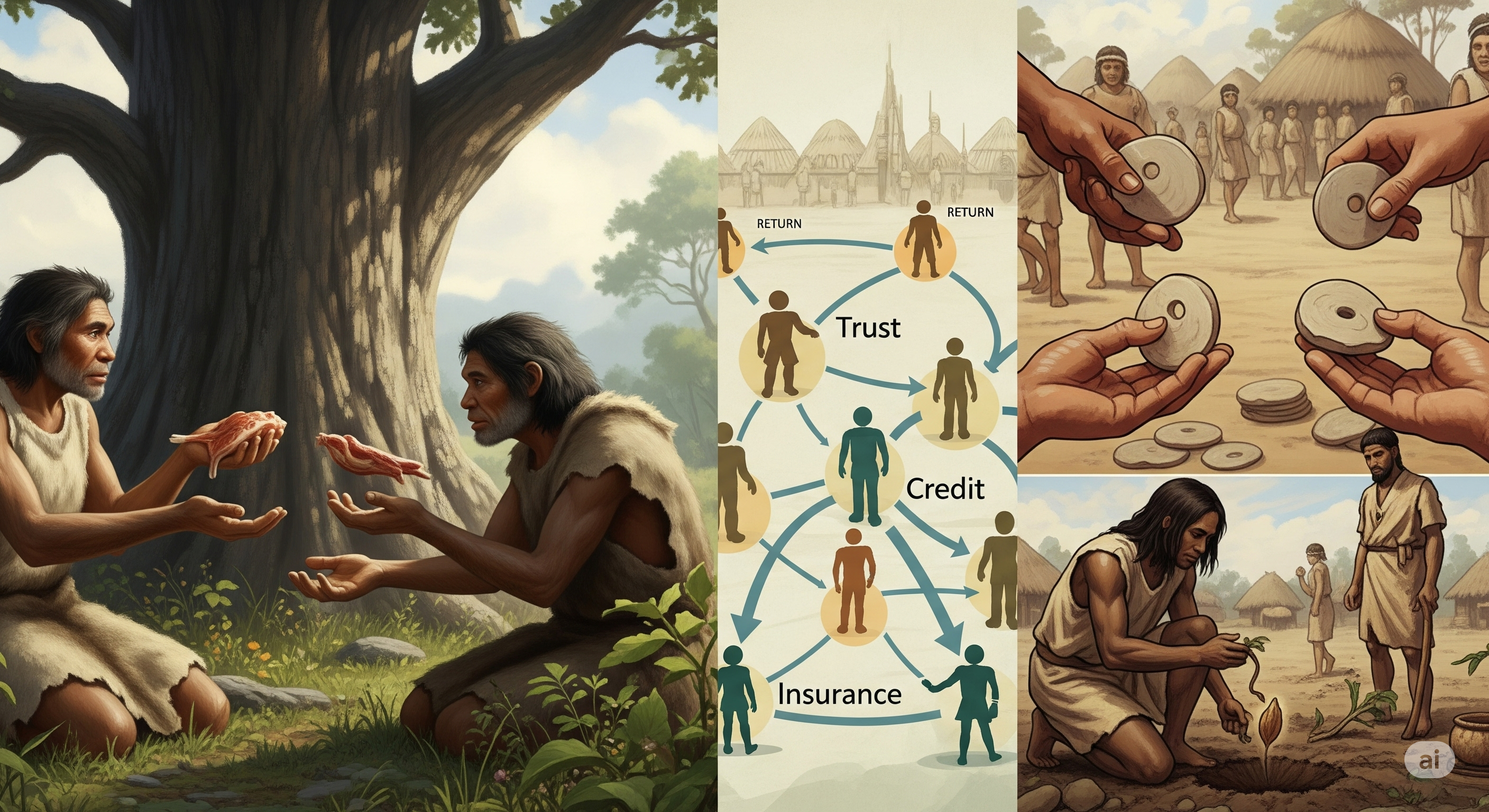

Reciprocity is more than tit-for-tat. It is a minimal social algorithm—“I help you now; you help me later”—requiring only memory, partner recognition, and sensitivity to return. Chimpanzees groom partners without immediate reward; hunter-gatherers share food expecting future help in lean times. These behaviors, devoid of contracts or institutions, sustain cooperation through feedback.

Diau reframes trade as the most symmetric and simultaneous form of reciprocity—a real-time cooperative swap. But it’s the extensions of this interaction—across time, risk, mediation, and projection—that give rise to what we recognize as finance:

| Financial Behavior | Reciprocity Extension | Behavioral Logic |

|---|---|---|

| Credit | Time delay | “I help now; you repay later.” |

| Insurance | Risk asymmetry | “I help in your bad times; you’ll help me in mine.” |

| Token Exchange | Indirect mediation | “I help someone; a token tracks that favor across partners.” |

| Investment | Future projection | “I give now, hoping for future gain from others.” |

Beyond Institutions: Modeling Emergence

Traditional financial models, from the Arrow–Debreu framework to CAPM, treat institutions as axiomatic. Even behavioral finance merely tweaks preferences within those frames. Diau flips the premise: what if institutions emerge from behavior, not the other way around?

He proposes a simulateable agent architecture requiring only:

- Partner-specific memory (e.g., “Agent A helped me 3 times”);

- Reciprocal evaluation (score partners based on net returns);

- Behavioral updating (cooperate more with high-score partners).

No roles, contracts, or enforcement are pre-coded. From this minimal substrate, simulations can track whether agent societies spontaneously generate financial macrostates:

- Credit appears as persistent asymmetric cooperation resolved over time.

- Insurance emerges from need-based support under stochastic harm.

- Tokens allow indirect reciprocity without dyadic memory.

- Investment arises from high-cost actions contingent on delayed return.

The Cognitive Line Between Chimps and Capital Markets

Notably, these extensions demand more than basic reciprocity. Token-based exchange requires abstraction; investment requires projecting others’ future behavior. While capuchins can use tokens in labs and chimpanzees show delayed reciprocity, only humans consistently stabilize these behaviors across large groups.

Diau marks this as a cognitive boundary: a threshold where behavioral simplicity gives way to structural complexity. Finance, then, is a natural outgrowth of advanced social cognition—evolved not through design, but through recursive interaction.

Implications for AI, Markets, and Models

This framework holds rich promise for multi-agent systems, especially those built on LLMs or decentralized protocols. Instead of pre-engineering smart contracts, we might allow AI agents to develop trust, credit, or risk-sharing behaviors through interactional learning. It reframes DeFi: not as institutional mimicry on-chain, but as the next testbed for bottom-up emergence of economic order.

Moreover, it offers a critical perspective on simulation: instead of measuring success by convergence to equilibrium, we might assess the emergence of structural regularities—“do these agents invent credit systems?” becomes a more revealing question than “do they optimize payoffs?”

Finance, in this view, is not a legal invention—it is a behavioral phenomenon. By rooting models in reciprocity rather than rationality, this paper opens new paths for designing artificial economies, understanding prehistoric trade, and perhaps even reinventing how we simulate cooperation itself.

Cognaptus: Automate the Present, Incubate the Future.