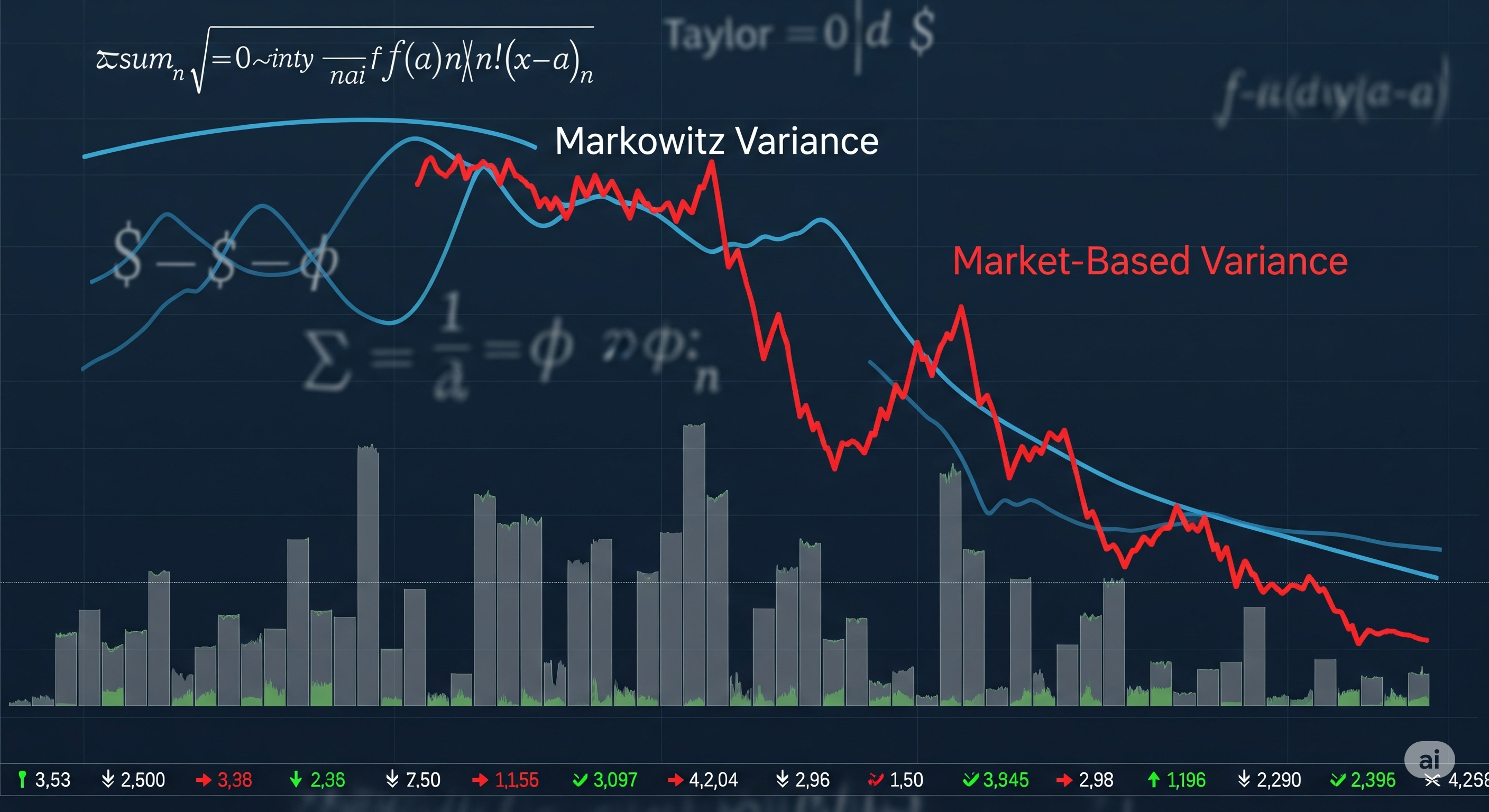

Volume Shock Therapy: Why Markowitz Risk Might Be Lying to You

Most risk models in finance still trace their roots to Harry Markowitz’s 1952 portfolio theory. His formula for portfolio variance has become institutional orthodoxy, from asset managers’ spreadsheets to central bank macro-models. But what if the model’s foundations are missing a critical component of today’s noisy markets? Victor Olkhov’s recent paper makes a sharp yet mathematically grounded argument: Markowitz variance drastically underestimates or overestimates true portfolio risk when trade volumes fluctuate — which they almost always do. ...