Causality Is Optional: Rethinking Portfolio Efficiency Through Predictive Lenses

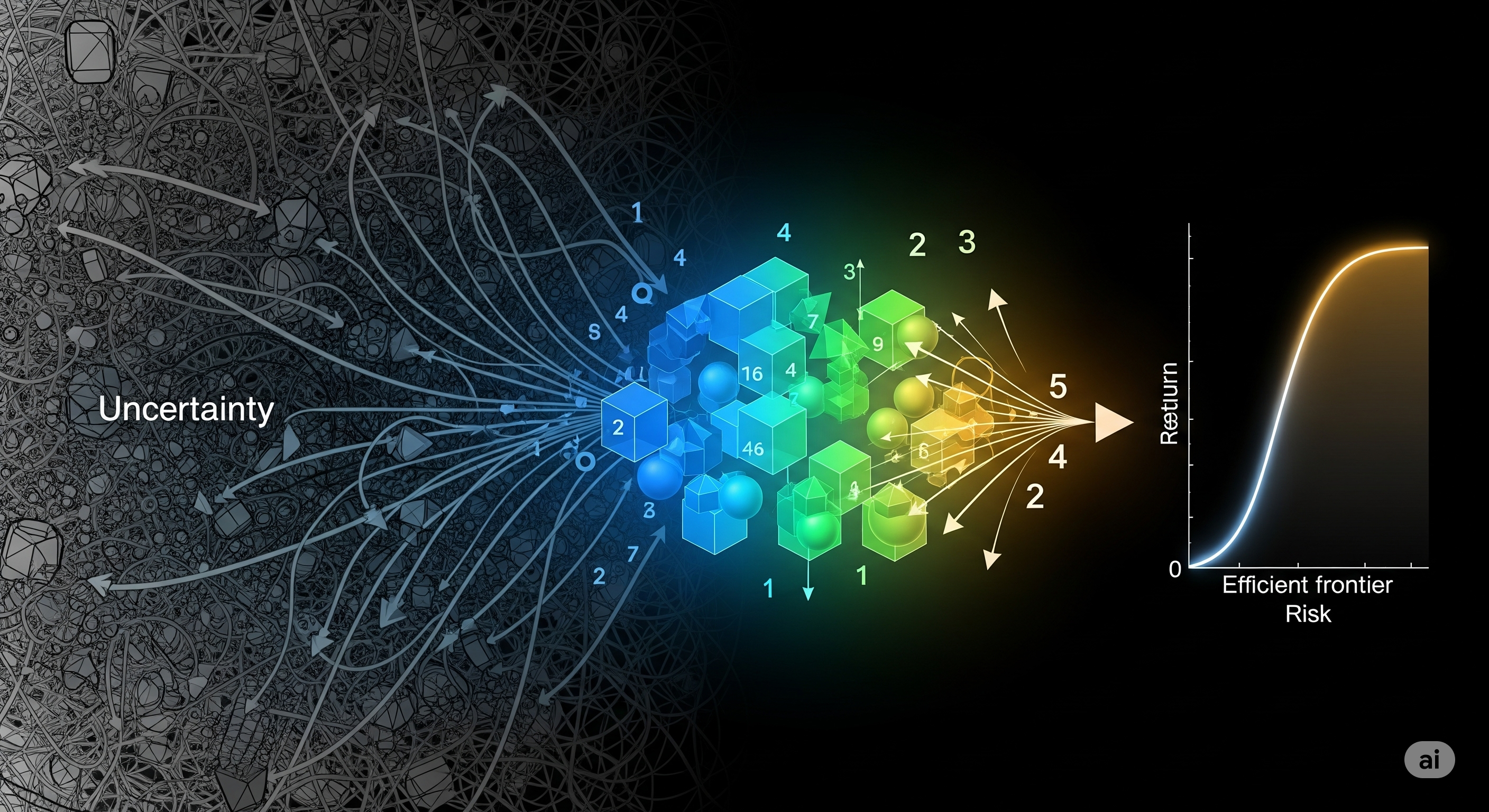

In asset management, few debates are more charged than the tug-of-war between causal purity and predictive utility. For years, a growing number of voices in empirical finance have argued that causal factor models are a necessary condition for portfolio efficiency. If a model omits a confounder, the logic goes, directional failure and Sharpe ratio collapse are inevitable. But what if this is more myth than mathematical law? A recent paper titled “The Myth of Causal Necessity” by Alejandro Rodriguez Dominguez delivers a sharp counterpunch to this orthodoxy. Through formal derivations and simulation-based counterexamples, it exposes the fragility of the causal necessity argument and makes the case that predictive models can remain both viable and efficient even when structurally misspecified. ...