Three’s Company: When LLMs Argue Their Way to Alpha

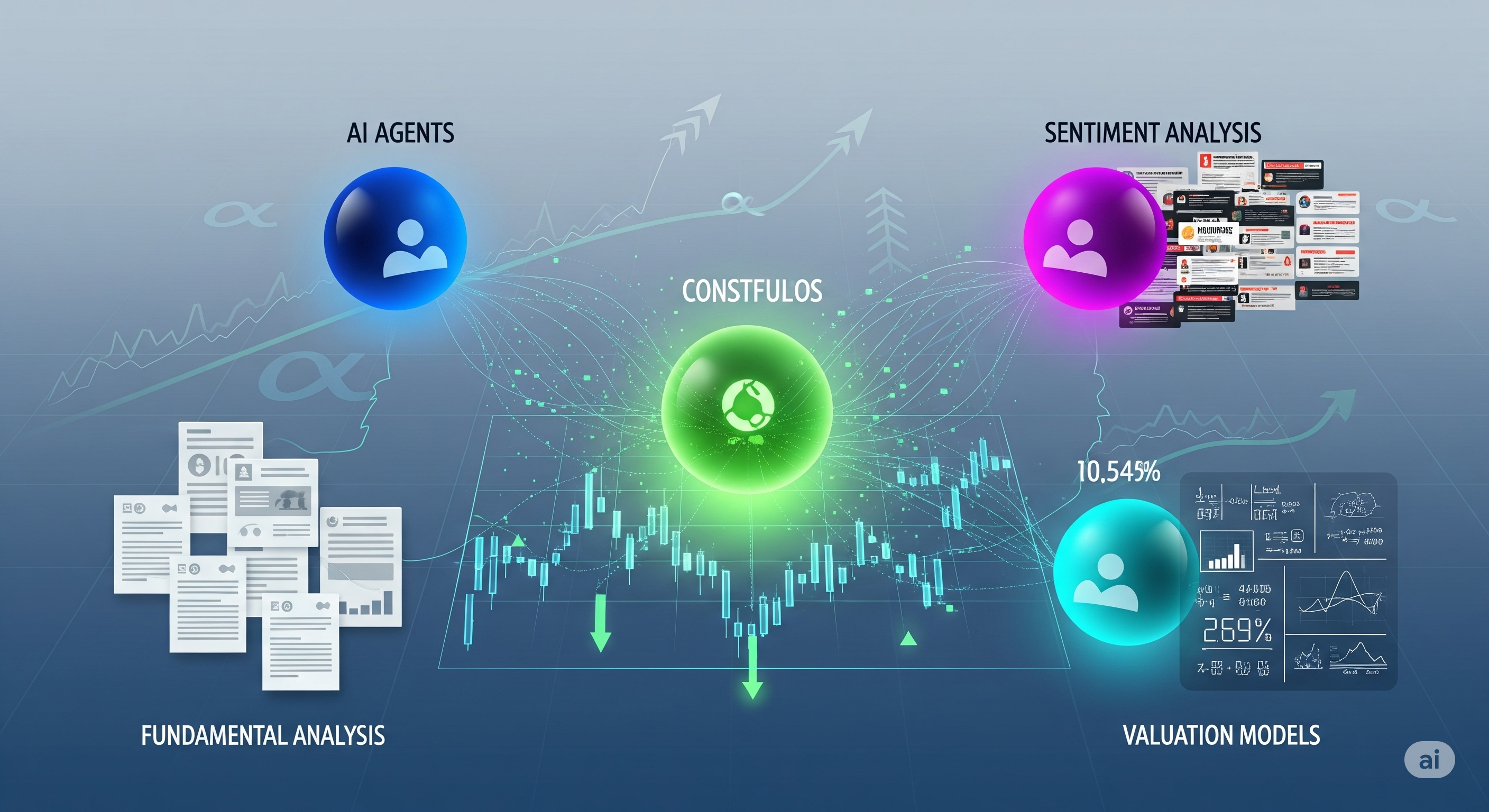

TL;DR A role‑based, debate‑driven LLM system—AlphaAgents—coordinates three specialist agents (fundamental, sentiment, valuation) to screen equities, reach consensus, and build a simple, equal‑weight portfolio. In a four‑month backtest starting 2024‑02‑01 on 15 tech names, the risk‑neutral multi‑agent portfolio outperformed the benchmark and single‑agent baselines; risk‑averse variants underperformed in a bull run (as expected). The real innovation isn’t the short backtest—it’s the explainable process: constrained tools per role, structured debate, and explicit risk‑tolerance prompts. ...