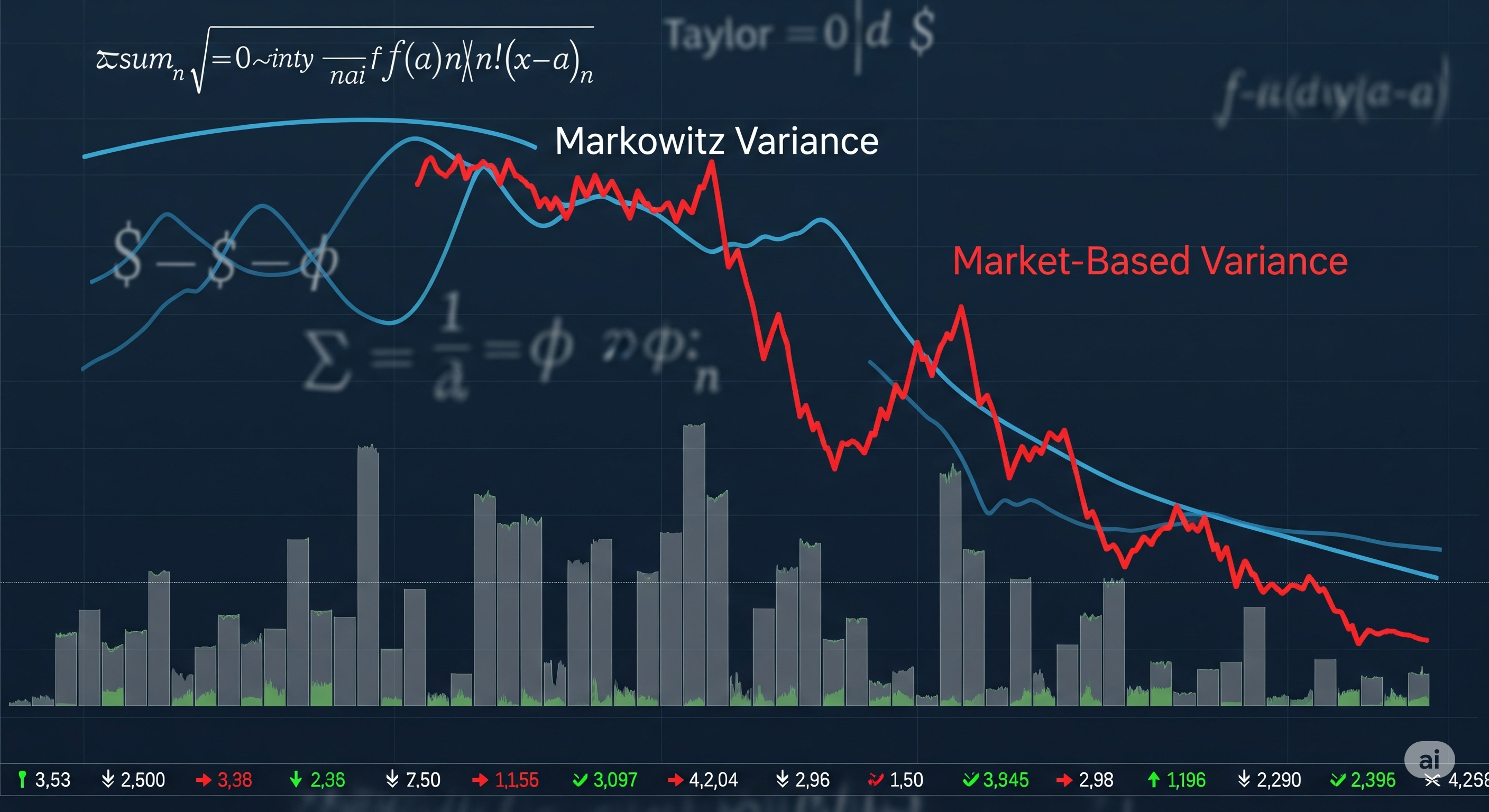

Most risk models in finance still trace their roots to Harry Markowitz’s 1952 portfolio theory. His formula for portfolio variance has become institutional orthodoxy, from asset managers’ spreadsheets to central bank macro-models. But what if the model’s foundations are missing a critical component of today’s noisy markets?

Victor Olkhov’s recent paper makes a sharp yet mathematically grounded argument: Markowitz variance drastically underestimates or overestimates true portfolio risk when trade volumes fluctuate — which they almost always do.

Markowitz’s Assumption: Constant Trade Volumes

Markowitz’s formula treats the variance of a portfolio as a quadratic form of asset weights and covariances. But it assumes something rarely made explicit:

All trades happen in equal volumes. Every time. Across all assets.

In reality, trading volume fluctuates wildly — and unpredictably. Market makers respond to demand, investors time entries and exits, and liquidity shifts minute by minute. Yet in Markowitz’s world, variance emerges only from return correlations, not volume noise.

A Market-Based Alternative: Variance with Volume

Olkhov redefines portfolio risk by embedding market trades — both values and volumes — into the calculation. He treats the portfolio as a synthetic single security, observing its trade time series just like an individual stock. This reframing leads to a more general variance expression:

$\Theta(t, t_0) = \mu(\psi, \chi, \phi) \cdot R^2(t, t_0)$

Where:

- $\psi$: coefficient of variation (CV) of trade values

- $\chi$: CV of trade volumes

- $\phi$: normalized covariance between trade values and volumes

- $R(t, t_0)$: gross return since time $t_0$

The traditional Markowitz variance $\Theta_M(t, t_0)$ is simply the special case where $\chi = 0$ — that is, no volume variability.

Taylor Series Correction: A Systematic Adjustment

To quantify the deviation from Markowitz, Olkhov derives a Taylor series expansion of the market-based variance in terms of $\chi$:

$\Theta(t, t_0) = [\psi_0^2 - 2a \psi_0 \chi + (1 - \psi_0^2) \chi^2] \cdot R^2(t, t_0)$

Where:

- $\psi_0 = \psi$ when $\chi = 0$

- $a$: normalized correlation factor between values and volumes

Depending on the sign and size of $a$, volume fluctuations can either dampen or amplify portfolio risk.

Three Cases that Break the Model

The paper analyzes three extreme cases:

1. High Return Volatility ($\psi_0 \approx 1$)

Markowitz variance nearly equals the squared return. But if $a > 0$, increasing $\chi$ lowers total risk. Markowitz overestimates risk.

2. Low Return Volatility ($\psi_0 \ll 1$)

Markowitz variance is tiny. But when $\chi$ grows, variance can rise sharply. Markowitz underestimates risk.

3. Zero Value-Volume Covariance ($\phi = 0, a = 0$)

Risk rises smoothly from Markowitz to full return variance as $\chi \to 1$. This shows even a neutral market can invalidate the Markowitz estimate.

| Case | Markowitz Bias | When It Matters |

|---|---|---|

| High $\psi_0$, positive $a$ | Overestimation | High-volatility portfolios, e.g. tech funds |

| Low $\psi_0$, any $\chi$ | Underestimation | Bond funds, risk-parity strategies |

| $a = 0$ | Underestimation | Market-neutral or volume-uncorrelated trades |

Why It Matters Now

This isn’t a theoretical nitpick. High-frequency trading, ETF rebalancing, and the microstructure of modern markets all depend on non-constant trade volumes. Risk models used by BlackRock or the Fed may fail to account for volume-driven variance — leading to systemic mispricing.

Portfolio managers trusting the classic variance estimate may either:

- Overhedge against noise that cancels itself out, or

- Underprepare for spikes in variance from volatile volume flows.

Final Thoughts

Markowitz’s formula remains a monumental achievement, but it’s also a zero-order approximation. Olkhov’s contribution is a reminder that markets are messy, and clean algebra hides dangerous assumptions.

Risk isn’t just about price — it’s also about how much is being traded, and when.

Cognaptus: Automate the Present, Incubate the Future