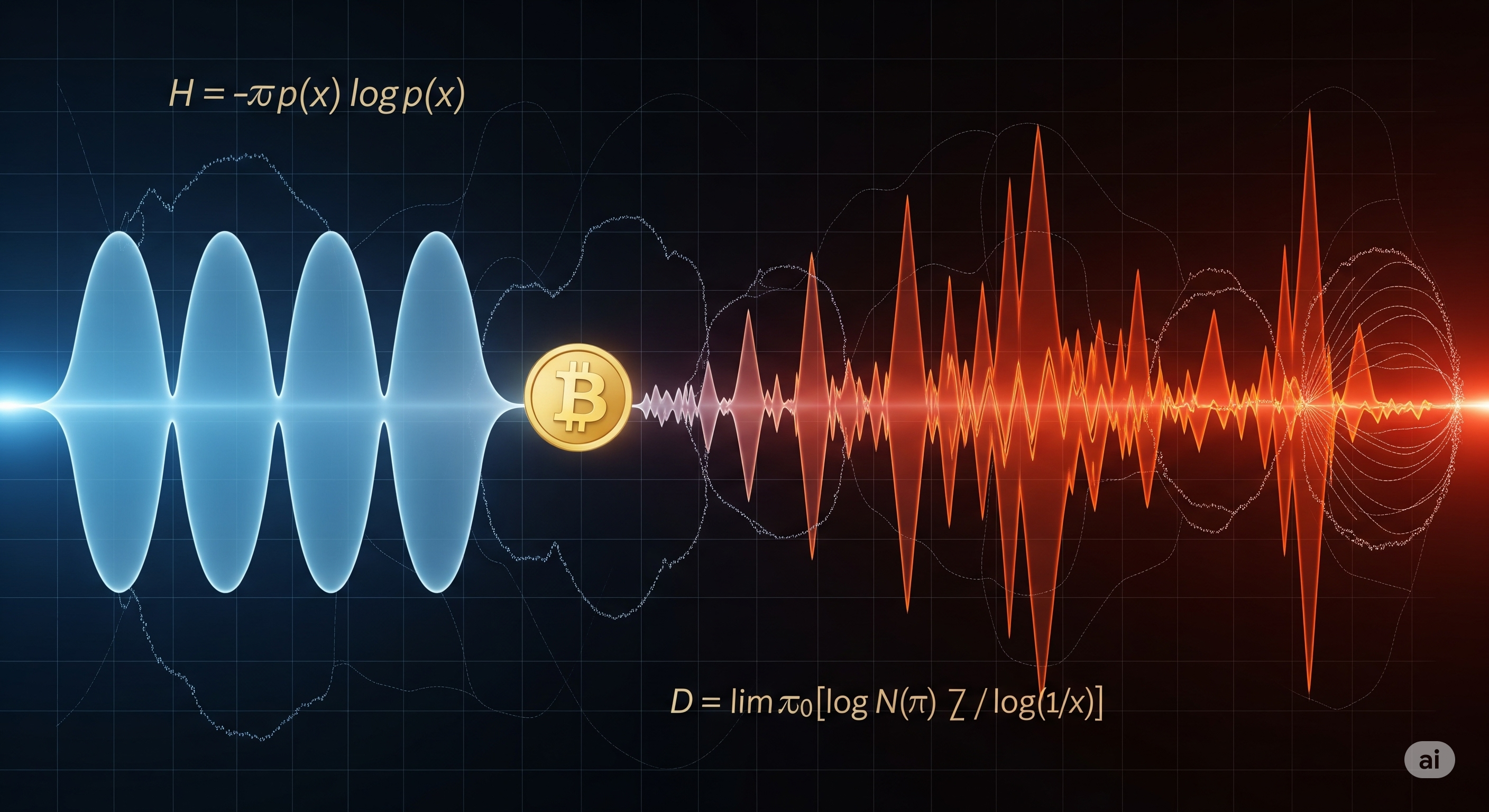

Why does Bitcoin feel so predictably unpredictable? A recent paper offers a rigorous perspective, arguing that the answer lies in its dual nature: highly regular in the short term, but richly chaotic across time.

Using two complementary techniques—Refined Composite Multiscale Sample Entropy (RCMSE) and Multifractal Detrended Fluctuation Analysis (MF-DFA)—the authors dissected the complexity of four major assets: Bitcoin, GBP/USD, gold, and natural gas. Their goal: measure how much structure hides within volatility.

Entropy and Fractals: Beyond Volatility

Traditional volatility metrics can capture dispersion, but they miss the temporal structure of fluctuations. Entropy-based tools like RCMSE tell us how predictable a time series is across multiple time scales. Meanwhile, MF-DFA quantifies how fractal-like the behavior is—i.e., how patterns repeat across resolutions.

These two tools offer a powerful synergy: entropy shows predictability, MF-DFA shows structural heterogeneity. Applied together, they give us a nuanced fingerprint of market behavior.

Key Findings

The authors analyzed the daily log-returns (2010–2024) of each asset and uncovered striking contrasts:

| Asset | RCMSE Complexity (Sum over 100 scales) | Multifractal Width (Δα) | Hurst Exponent (H) |

|---|---|---|---|

| Bitcoin | 74.66 | 0.62 | 0.51 |

| GBP/USD | 67.24 | 0.50 | 0.49 |

| Gold | 67.88 | 0.44 | 0.48 |

| Natural Gas | 51.48 | 0.21 | 0.50 |

-

Short-term order, long-term chaos: Bitcoin exhibits low entropy at small scales, meaning it’s more predictable in the short run. But as scale increases, entropy grows dramatically—implying more chaotic behavior across longer horizons.

-

Rich multifractality: Bitcoin’s log-return series has the widest multifractal spectrum, indicating a mix of large and small fluctuations governed by different dynamics. This suggests multiple overlapping processes—not just random noise.

-

Non-linear dependencies: After shuffling the time series (which destroys time-dependent structure), Bitcoin’s entropy increases and its multifractal spectrum shrinks significantly. The other assets show minimal change. This signals that Bitcoin contains genuine nonlinear temporal correlations.

Why This Matters

1. Risk Modeling Needs to Be Multiscale

Most VaR and volatility models operate on fixed time frames. But this research shows that asset complexity varies by scale. Bitcoin, in particular, may appear tame under short-term models but erupt into chaos over longer horizons.

2. AI Forecasting Should Adapt to Scale-Dependent Structure

LLM-powered financial agents and machine learning models need to account for varying entropy across time scales. A static model may fail to capture Bitcoin’s regularity at short lags and unpredictability over longer ones.

3. Cryptocurrency vs. Traditional Assets

The findings underscore that crypto assets are not just high-volatility versions of traditional ones. They behave differently at a structural level. Bitcoin’s unique combination of short-term predictability and long-term fractal richness may reflect speculative herding, network-driven sentiment, or algorithmic pattern exploitation.

Final Thought: Predictability Isn’t Linear

The most telling insight? Predictability is not a scalar, but a fractal landscape. Bitcoin doesn’t sit on a spectrum from random to regular; it oscillates between them depending on the scale of observation.

This duality makes it both fascinating and treacherous. And as this paper shows, analyzing that duality requires tools that can operate across scales and beyond linear thinking.

Cognaptus: Automate the Present, Incubate the Future.