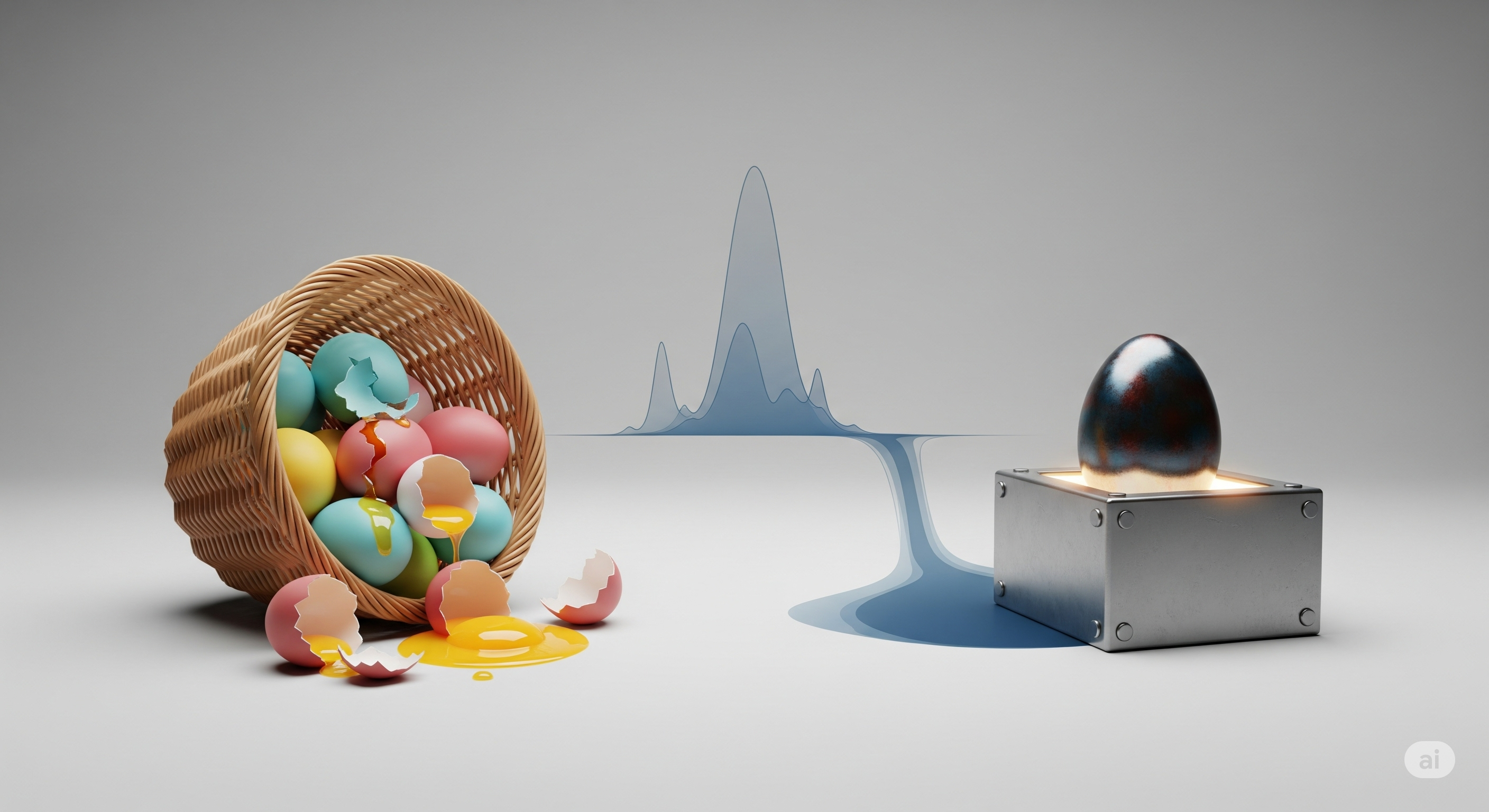

“Don’t put all your eggs in one basket” has long been gospel in finance and risk management. But what if sometimes, the basket is the safer place?

In a surprising twist on conventional wisdom, Léonard Vincent’s latest paper presents the one-basket theorem: a theoretical framework that proves diversification can increase risk under certain extreme but relevant conditions. Specifically, when dealing with heavy-tailed risks that have infinite mean — such as those found in insurance, operational risk, and even crypto markets — putting all your eggs in one basket may be the rational choice.

When Diversification Fails

Under most conditions, diversification lowers volatility. That’s the basis of modern portfolio theory. But this rests on the assumption of finite moments (i.e., finite mean and variance). What happens when these assumptions break?

Vincent builds on recent findings that show for infinite-mean Pareto risks, a diversified portfolio (i.e., a weighted average of individual risks) can be riskier than a single exposure. Formally:

If X ~ Pareto(α), α ∈ (0,1], then:

X ≤ₛ θ₁X₁ + ⋯ + θₙXₙ

In other words, any decision-maker with an increasing utility function would strictly prefer one risk to the diversified sum. This overturns the usual assumptions of benefit from risk pooling.

Mixture vs Average: Two Ways to Hold Risk

The paper contrasts two ways of holding risk:

| Portfolio Type | Definition | Behavior under Infinite Mean |

|---|---|---|

| Diversified (Average) | Fixed-weight average of independent risks | Risk increases |

| Concentrated (Mixture) | Randomly select one risk (weighted coin flip) | Lower risk profile |

The key intuition: diversification increases the likelihood of exceeding small thresholds. And under certain scaling conditions, this local effect becomes global, leading to full stochastic dominance.

Subscalability: The Heart of the Matter

To formalize the intuition, Vincent introduces a new concept: subscalability.

A distribution is θ-subscalable if: $\theta \cdot P(X > x) \leq P(X > x/\theta) \text{ for all } x \geq 0$

This expresses a kind of tail stubbornness: shrinking the variable by θ doesn’t proportionally reduce the tail risk.

Two key types:

- θ-subscalable risks: Valid only for specific values of θ

- Completely subscalable risks: Valid for all θ in (0,1). These include distributions like Fréchet(1) and convex transformations of it (i.e., the super-Fréchet family).

Subscalability is necessary for the one-basket theorem to apply — and it reveals an important link: such risks must have infinite mean.

Concrete Examples: When One Egg Wins

1. Non-identical Pareto Risks

Even with differing shape and scale parameters, the average of Pareto(αₙ, ρₙ) random variables with αₙ ≤ 1 is stochastically worse than the mixture.

2. St. Petersburg Lottery

A classic infinite-mean example. For any n that’s a power of two, the average of n independent St. Petersburg lotteries is worse than picking one at random.

3. Discrete Pareto

A version with support on integers can still obey the one-basket dominance rule, but only for specific weights θ. This shows weight-specific fragility in discretized models.

Implications for Risk Practice

- Insurance Design: In randomized reinsurance, it might be safer for the reinsurer to cover one full loss at random (a mixture) than to spread coverage across many claims (a quota-share average).

- Crypto & Tail Risk Portfolios: If returns follow infinite-mean distributions (e.g., log-Pareto, super-Cauchy), then diversified holdings may increase exposure to catastrophic drawdowns.

- Risk Simulation & Monte Carlo: Many stress test frameworks assume benefit from pooling. But in extreme-risk scenarios, averaging can worsen tail events, potentially underestimating systemic vulnerability.

Final Thought: More Isn’t Always Safer

The one-basket theorem doesn’t argue against diversification in general. Instead, it carves out a boundary regime where our most cherished heuristics collapse. It reminds us that the shape of the tail matters more than the count of baskets.

As machine learning and risk models increasingly deal with fat-tailed and adversarial distributions, this line of thinking may guide better algorithmic resilience and portfolio design.

Cognaptus: Automate the Present, Incubate the Future